If you’re thinking about starting a party rental business, you might not realize yet that insurance quickly becomes one of your most important ongoing expenses after buying inflatables, tents, tables, and chairs.

If you’re already running a party rental business, you almost certainly have some kind of insurance in place. But a lot of operators don’t really understand how their coverage works until an accident forces them to take a hard look at the policy details.

In the party and event rental world, the risk of serious injury is always there, and it’s not a responsibility you want to carry on your own. Also, if you plan on servicing schools, churches, organizations, or public facilities, you’ll usually be required to show proof of insurance before you can even step on site.

The right insurance coverage helps protect your business, your equipment, and your income when something goes wrong, so a single incident doesn’t wipe out years of hard work.

But insurance policies for party rental businesses aren’t “off the shelf,” instant online quotes like car or homeowners insurance. These are specific policies that require some knowledge, research, and multiple quotes to determine which one will work best for your party rental business.

But insurance for party rental businesses isn’t an “off-the-shelf” instant online quote like car or homeowners insurance. These are specialized policies that it usually require some research, conversations, and a few quotes to figure out which one is the right choice for your party rental business.

In this guide, we’ll break down the types of insurance party rental businesses actually need, why each one matters, what really drives your premiums, and how to think about those costs so you can plan ahead and keep your coverage affordable.

TL;DR

- Party and event rental businesses have higher, more complex risks than typical small businesses, so specialized insurance will be required

- Core policies are usually general liability and commercial auto, with participant accident, inland marine, and umbrella coverage added as a business grows

- There’s no fixed price for party rental insurance—premiums depend on factors like location, equipment type, business size, and claims history

- Event Rental Systems (ERS) makes your business more “insurable” by standardizing rental agreements and reporting so claims, audits, and renewals run smoother

Why Party Rental Businesses Need Specialized Insurance

In a nutshell, an insurance policy is a simple trade-off: you pay a regular premium, and in return the insurer takes on some of the risk your business faces in everyday operations.

Almost every small business needs some level of insurance, but party and event rental companies carry unique risks that insurers look at differently when they decide what coverage to offer and what to charge.

Amusement rental operations carry a unique risk profile that most standard insurance programs simply don’t understand. These businesses involve temporary installations, frequent transportation, public interaction, children, weather exposure, and equipment that presents inherent risk. Industry-specific insurance ensures the policy is designed by carriers who understand how these businesses actually operate and how claims occur.

—Kyle Teeples, OVD Insurance Agency, Grand Rapids, MI

These higher risks stem from:

- Parties hosted at off-site locations (homes, parks, schools, venues)

- Delivery/setup/teardown creating added risk of damage or improper setup

- Your equipment being used by the public in instances where you have limited control once the event begins

- Higher likelihood of bodily injury due to physical activity (especially for inflatables)

This combination of off-site locations, setup and teardown, public use, and physical activity creates exposures that many standard “small business” policies don’t fully cover.

Because of these industry-specific risks, you need insurance coverage designed specifically for party and event rental businesses, or you could face significant out-of-pocket costs from coverage gaps you didn’t know you had.

The Core Insurance Policies Every Party Rental Business Needs

While coverage needs can vary based on what you rent, how you operate, and the size of your operation, there are a few types of insurance that every party or event rental business should have.

These core policies protect you from the most significant financial risks and are often required by venues, municipalities, and commercial clients before they’ll allow you to operate on-site.

At a minimum, these core policies are designed to address three major risk areas:

- Injuries to guests or bystanders (third-party injuries)

- Damage to a customer’s home, a venue, or a third-party’s property

- Vehicle accidents during deliveries and pickups

For most party rental businesses, this foundation comes down to two core policies: general liability and commercial auto. Let’s start with those, since they’re the coverages that most venues require and most operators can’t function without.

General Liability Insurance

General liability insurance is the foundation of most party rental insurance plans because it protects your business when someone claims you caused bodily injury or property damage. In plain terms, it’s the policy that responds when a guest gets hurt, or when something you deliver or set up damages a home, venue, or facility.

It also typically includes legal defense, which is important because even a questionable claim can become costly once attorneys and investigations are involved.

When it comes to insurance for party rental businesses, general liability commonly applies to situations like an injury to a child bouncing on an inflatable, a table collapsing and injuring someone, or equipment causing damage to a client’s property during setup or teardown.

It’s also the coverage most schools, churches, and venues are looking for when they request a certificate of insurance (COI), since it’s designed to protect third parties and confirm you have the financial backing to handle a serious claim.

That said, general liability isn’t a “one size fits all” policy.

It may not cover certain high-risk items unless they’re specifically included (inflatables are a common example). In many cases, your coverage also depends on you following specific safety measures in your day-to-day operations.

For example, proper anchoring, respecting wind limits, and your written safety rules can all affect how a claim is evaluated. That’s why it’s so important to have a policy written for party and event rental operations that accurately reflects what you rent and how you operate.

General liability is a foundational policy for your event rental business. Think of it as the protection that has to be in place so you can book events with confidence and keep a single serious injury or property damage claim from becoming a business-ending expense.

As we’ll explain later, it’s coverage you must have in place, but not something you want to tap for every minor bump, bruise, or mishap, because using it unnecessarily can cost you far more over time.

Commercial Auto Insurance

Operating in the event rental business means you’re delivering equipment to homes, schools, churches, and venues every weekend. The vehicles and drivers you use to make those deliveries will log a lot of hours on the road driving from storage to party locations and back.

Delivery plays a huge role in the event industry, with many companies employing full-time drivers, and spending lots of time and money optimizing delivery routes for party rentals.

Because accidents happen, you need insurance in place so that anything that goes wrong during a delivery doesn’t come straight out of your pocket

Even if you’re a start-up operator using your personal vehicle to make deliveries, it’s a mistake to assume you’re automatically covered if an accident happens. Once you’re using that vehicle “for business,” many personal auto policies can deny a claim.

A few examples of what can go wrong making deliveries would be:

- You or your driver damaging customer property while driving a delivery truck

- Someone hits your delivery vehicle while it’s on the way to an event

- An employee gets into an accident while using their own vehicle to bring extra items to an event

If you don’t have a commercial auto policy in place, any accident that occurs, or damage you cause in the process of making a delivery could be costly.

A commercial auto policy is designed to cover things like accidents while delivering or picking up equipment, property damage you cause with a vehicle, injuries to other drivers or pedestrians when your driver is at fault, and damage to your own vehicle if it’s covered for collision and comprehensive.

Having general liability and commercial auto policies in place are what prevent serious accidents from ending your business. But for most event rental operators, these policies should be just the foundation, not the ceiling.

The reality is that if you relying on just these two policies to take care of everything, that may not be the best approach for your event rental business.

In the next sections, we’ll look at additional coverages that cover common gaps and are more cost-effective than just relying on “foundational coverage,” so you a delivery mishap or accident doesn’t completely derail your operation.

Optional Coverages That Close Common Coverage Gaps

Once the core policies are in place, many party rental businesses add additional coverages to address gaps that show up in real-world situations. These policies aren’t always required to operate, but they can make a meaningful difference in how incidents are handled, how claims affect your renewal, and how much risk you ultimately keep on your own balance sheet.

In practice, these add-ons are often what separate businesses that merely meet insurance requirements from those that are thinking long-term and want to be prepared before something goes wrong.

Participant Accident Insurance

Compared to many other small businesses, party rental companies that rent inflatables and bounce houses face a much higher chance of someone getting hurt. With kids climbing, jumping, and running around your equipment, you have to assume that over time you’ll see everything from minor bumps and sprains to more serious injuries.

Now, you may be under the impression that your general liability policy will cover any accidents that can happen involving your equipment.

While that’s true, general liability claims often take a long time to resolve. In many cases, your policy will come up for renewal before the claim is closed.

If you have an open general liability claim on your record when it’s time to renew, underwriters may now see your business as higher risk. Which can translate into significantly higher premiums, sometimes adding several thousands of dollars over the life of the policy.

With this in mind, participant accident insurance is often the best way to handle most injury-related costs. It’s there to help take care of medical bills quickly, even for more serious injuries, without immediately dragging your general liability policy into every incident.

Participant accident insurance helps protect your general liability limits and claims history for the truly worst-case scenarios, while still making sure guests are taken care of and your business looks responsible and prepared.

Cyber Liability Insurance

An online booking system has pretty much become a must-have feature for currently operating party rental businesses. However, using such a system also means that you are taking on the responsibility of protecting your customers’ info and payment information.

While cyber crime would be a more common occurrence with financial institutions and e-commerce businesses, any business that collects customer data and processes payments online can be a target. If your party rental business collects customer information and processes payments online, you’re taking on the risk of cyber criminals stealing that data.

The fallout from a cyber attack goes far beyond restoring your website and includes:

- Customer data exposure (personal info and payment details)

- Financial losses (fraudulent charges, chargebacks, and theft)

- Business interruption (downtime and delayed operations)

- Breach response costs (forensic IT, legal help, customer notification, and credit monitoring)

- Reputational damage (lost trust and future bookings)

Cyber liability insurance is designed to help with incidents like these. Depending on the policy, it may cover expenses related to a data breach (like customer notification, credit monitoring, forensic IT work to find what happened, and legal support), as well as costs tied to cyberattacks that disrupt your business (like ransomware, data restoration, and certain business interruption losses). For party rental companies that store customer contact details, addresses, and payment information, this coverage can close a gap that general liability typically doesn’t address.

If your party rental business relies on features like online deposits, digital invoices, and online booking to keep things moving, cyber liability coverage is worth considering as a valuable add-on.

Inland Marine Insurance

Inland marine insurance is one of the most practical coverages a party rental business can add once you’ve got your core liability and vehicle coverage in place.

Inland marine coverage is a type of policy that protects your business’s portable equipment. In the party rental world, that usually means things like inflatables, tents, and other gear that’s stored in one place, transported by vehicle, and set up at off-site locations.

General liability is designed to cover you when you damage someone else’s property or when someone is injured while using your equipment. It does not protect the items in your inventory themselves.

That’s where an inland marine policy has real value.

If your inflatables, tents, or other equipment are stolen, damaged at an event, or damaged in transit, inland marine coverage can help pay for repair or replacement.

Because your entire business depends on your inventory going out and coming back in one piece, inland marine coverage fills the gap by protecting your revenue-driving equipment, not just the liability you take on when you rent it out.

Store your event rental equipment with confidence with help from our recent article: How to Store Event Rentals | Inflatables, Tents, Mechanical Rides & More

Additional Policies for Growing Party and Event Rental Businesses

Like a lot of industries, insurance policies are not cookie-cutter solutions for all party and event rental businesses. The reality is that large and small event rental companies won’t need the same limits or mix of policies to have adequate coverage for their assets and liabilities. And many small businesses are limited by what they can realistically afford.

If you operate a small business that’s starting to scale, it’s important to review and update your coverages as your business grows.

Kyle Teeples, a risk management and commercial insurance agent at OVD Insurance Agency, says one of the most common mistakes he sees is operators not updating their policies as their inventory expands.

That’s why, as your operation moves beyond a one-person, one-truck setup, your insurance program needs to scale with it so your current assets and liability exposures are actually covered.

Otherwise, you could end up with coverage gaps that put all the hard work you’ve done to reach this stage at risk.

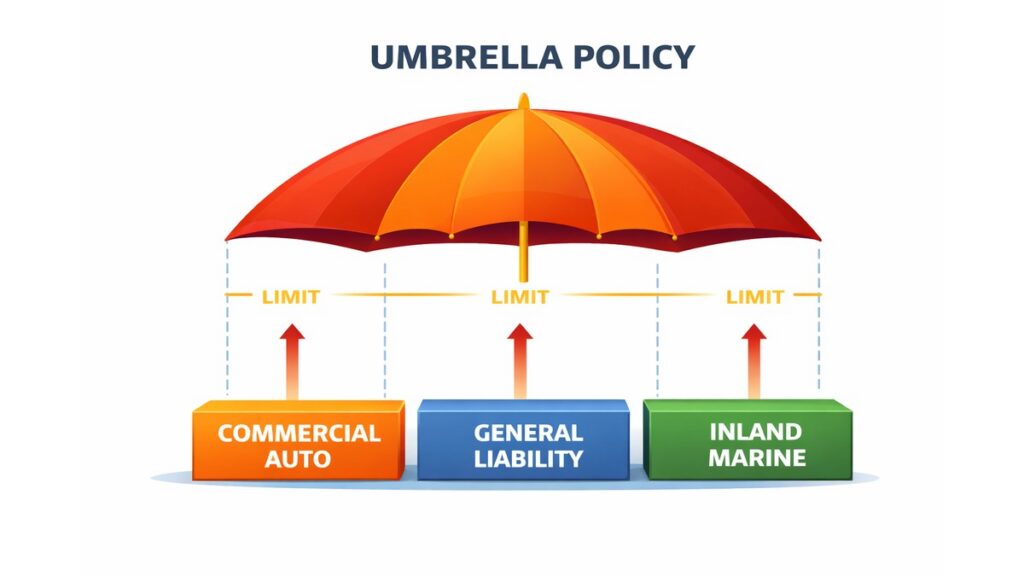

The coverages that wouldn’t have made sense to carry early on—like workers’ compensation or a commercial umbrella policy—can become essential once you’re running multiple crews, vehicles, and higher-risk events.

Insurance for party rental businesses changes with expansion. Here are two of the most common “next-level” policies to keep on your radar as you grow.

Worker’s Compensation Insurance. Once you have employees handling deliveries and setups, workers’ comp quickly shifts from “nice to have” to “non-negotiable.” It covers employee injuries that happen on the job (back strains from lifting equipment, falls while setting up, or accidents while driving a company vehicle). In many states it’s legally required once you hire staff, so it tends to become one of the first (second level) policies for growing event rental businesses.

Umbrella Policies. A commercial umbrella policy sits on top of your general liability and commercial auto coverage (and add-on policies like inland marine if you carry them) and kicks in if a large claim exhausts those underlying limits. For companies handling bigger events, higher attendee counts, or more complex setups (tents, rides, concessions, multiple trucks on the road), an umbrella can be a relatively affordable way to add an extra layer of protection against worst-case injury or property damage claims.

How Much Does Insurance Cost—and What Really Keeps It Affordable?

Insurance pricing varies widely, and the numbers below are ballpark ranges pulled from publicly available interviews and presentations by insurance professionals who work with party rental businesses.

Because carriers look at a long list of factors, there isn’t a fixed price for party rental insurance.

Instead, your premium is based on things like:

- The state you operate in

- How much revenue you generate

- The type of equipment you rent (Ex. tables and chairs vs. inflatables and mechanical bulls)

- How many employees you have

- Your claims history

That said, $4,000 —$5,000 a year should be the minimum for what you should expect to pay for a general liability policy with commercial auto coverage having a minimum in the $1,000 — $2,000 a year range.

Add-on policies like participant accident, cyber liability, and inland marine will likely have minimum premiums in the $500 or less range while worker’s compensation will probably be $500 or more.

Important: These figures are not quotes. The only way to know your true cost is to get quotes based on your state, revenue, equipment mix, and claims history.

Although there isn’t much you can do to lower your initial premium, there are solid strategies for keeping your insurance affordable over time.

One of the most important is being intentional about when and how you use your general liability coverage, especially for third-party injuries. Another is running an organized, well-documented, and transparent operation that insurers like to work with—and the easiest way to do that is by investing in party rental software to keep all your contracts, waivers, and financial data all in one place.

Why Streamlining Your Party Rental Business With Software Matters for Insurance

Insurance is the safety net that protects your business when something goes wrong. But in the real world, how those claims play out often depends on how organized and well-documented your operation is.

When an incident happens, carriers and underwriters care about consistency, documentation, and how clearly you can show what was agreed to, what was delivered, and how the event was handled. Teeples says a costly mistake operators make is treating insurance as a once-a-year purchase instead of an ongoing risk management strategy.

Event Rental Systems software helps you avoid that mistake by streamlining your operation and helping you run a more organized business, which can have a huge impact on claims, renewals, and growth. ERS standardizes the parts of your operation that become crucial to insurance companies when they review a claim or your account, including rental agreements, waivers, and financial reports, so you can respond quickly and keep your business moving.

Here are a few practical ways ERS helps support that:

Digital rental agreements and signatures. Having a clear, signed rental agreement helps reduce disputes and misunderstandings, especially after an incident or damage claim. That kind of documentation helps you apply consistent terms for each rental and supports claim defensibility. ERS standardizes how deposits, damage responsibility, weather policies, and venue requirements are communicated and sets clear expectations before delivery day.

Fast reporting for insurance renewals and audits. Insurance renewals and audits often require accurate numbers for revenue, payroll, and other operating data. If those numbers are off, you can end up with an “unpaid premium” bill and higher rates at your next renewal. ERS reporting makes it easy to pull clean figures quickly, reducing the risk of errors, delays, or surprise adjustments.

Financial visibility to budget for insurance. Insurance is a major operating expense, and it changes as your revenue and inventory grow. ERS helps you track revenue and costs so you can plan for renewals, manage overhead, and decide which optional coverages actually make sense to buy.

A more “insurable” operation over time. Many carriers prefer businesses that run with consistent processes and clean documentation. ERS helps you build an organized, trackable, and transparent operation, which is exactly what underwriters want to see when they review your account. Some insurance professionals even note that certain carriers may be more willing to offer discounted premiums to operators who use rental software, because it signals a more organized, lower-risk business.

In addition, ERS helps streamline day-to-day operations with tools like:

- Online booking

- Inventory management

- Integrated payments

- Customer relationship management

If you want to build a strong event rental business, ERS helps you stay organized, better protected, and ready to scale. If you’d like to see ERS in action.

If you’d like to see ERS in action, schedule a demo.

Frequently Asked Questions

Do I Really Need Specialized Insurance if I’m Just Doing Small Backyard Parties?

Yes. “Small backyard parties” are still commercial events often held on someone else’s property. This makes your risk different and the coverage you need will have to be more specialized than generic “small business” coverage. A policy written specifically for event rentals lets the insurer price the risk correctly and clearly cover what you do, so if a guest trips over a cord or a bounce house shifts in the wind, you and your business are protected. When purchasing insurance for party rental businesses, it’s worth working with an insurance professional who understands the party and event rental industry.

What’s the Difference Between General Liability and Participant Accident Insurance—and Do I Need Both?

General liability (GL) is your core, “protection” policy. It’s there if you’re accused of causing injury or property damage to someone else. It’s also the coverage most venues, cities, and schools look for on your certificate of insurance (COI) to be able to work certain events.

Participant accident insurance is more targeted. It’s usually a lower-cost add-on designed to help pay medical expenses when someone gets hurt at your event (like a broken bone or ER visit), for the purpose of avoiding a full-blown general liability claim.

In practice, many party and event rental businesses carry both: they use participant accident coverage to handle most injury-related medical costs and try to reserve their general liability policy for only the largest, most serious claims, since frequent GL claims can become expensive over the long term.

What Is Inland Marine Insurance, and When Does a Rental Business Actually Need It?

Inland marine insurance is a type of coverage that protects your portable equipment. For a party or event rental business, that usually means inflatables, tents, tables, chairs, concessions, generators, and other higher-value inventory.

You typically start needing inland marine coverage once you have meaningful money invested in equipment and you’re moving that equipment from place to place. There’s no single dollar amount, but if you’re not in a position to replace lost or stolen gear out-of-pocket, then an inland marine policy is worth looking into.

How Does Using Software Like Event Rental Systems (ERS) Help With Insurance, Claims, and Renewals?

ERS simplifies drafting and storing rental agreements and other documentation in case you need to present them to your insurance company for a claim. It also makes it easy to run financial reports and share other operational data your carrier may request for audits or renewals. Over time, this helps your business look more “insurable” to carriers and can even help you avoid insurance-related surprises or unnecessary costs.

The information in this article is for educational purposes only and should not be considered financial, business, or legal advice. Insurance rates and requirements can vary widely based on location, business size, operations, and requirements. Always do your own research and consult a qualified professional before making any decisions regarding insurance or finances.